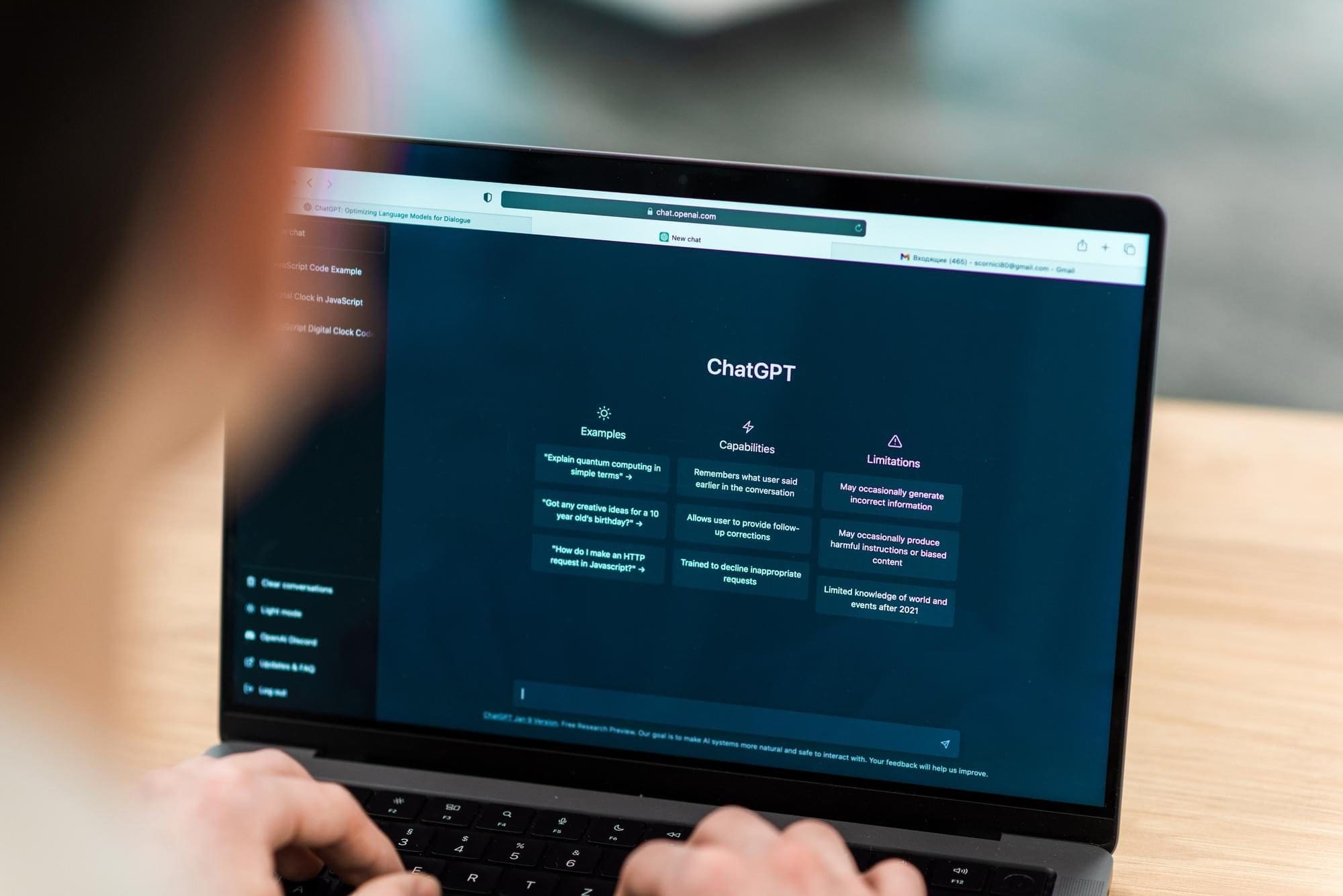

ChatGPT is capable of instantly providing you with everything from personalized tarot card readings, to Instant Pot recipes and even has the potential to radically change the professional landscape with ChatGPT for accounting. The question on our minds (and hopefully, yours) is — is ChatGPT safe enough?

ChatGPT for Accounting – FTC Safeguards Rule

As any CPA worth their salt will tell you, professional tax return preparers must adhere to FTC Safeguards Rule, which requires them to create and enact written information security plans to protect taxpayer data. By doing so, they ensure that their clients’ personal data and financial information is secure and private. Furthermore, online providers of individual income tax returns are held to the six security and privacy standards in Publication 1345, Handbook for Authorized IRS e-file Providers of Individual Income Tax Returns.

What Does the Law Say about Using ChatGPT for Accounting Purposes?

As of yet, there isn’t too much being said on responsible usage of ChatGPT for accountants. That being said, taxpayers have the undeniable right to expect that their sensitive financial information be handled responsibly. It is the responsibility of the professional tax return preparer or online provider to take steps necessary to protect taxpayer data as required by FTC Safeguards Rule and IRSA Publication 1345. Failure to do so may result in FTC investigation. Protecting taxpayer data is not only the law, but also essential to maintain trust and confidence between providers and their clients. Generally speaking, this exchange of information takes place via standard practice, either an in-person interface, via mail or email. But with ChatGPT that is likely set to change.

Using the Power of ChatGPT to Exponentially Multiply Yourself

“With great power comes great responsibility,” isn’t just a Spiderman platitude. As a powerful tool that can revolutionize the way that accounting firms manage their client data, ChatGPT has the potential to exponentially increase the number of clients a single firm can take on. With the platform, firms can create secure and tailored conversations with their clients in order to exchange information faster, more securely, and at lower costs compared to traditional communication methods.

Audit Trail Tracking

ChatGPT also allows for audit trail tracking which helps ensure proper documentation and safeguarding of private information. Additionally, the automated nature of ChatGPT conversations makes it easier for accounting firms to keep up with new regulations and compliance benchmarks without needing to invest heavily in manual labor or training. Additionally, chatbots can be programmed to only collect as much personal information as necessary for a particular task or transaction – further helping to protect privacy and minimize any associated risks.

By taking all the necessary steps to protect taxpayer data, professional tax return preparers ensure that both individuals and businesses are able to have faith when sharing sensitive financial information. This trust is essential for the financial services industry to function properly. The FTC and IRS are committed to protecting taxpayers from data breaches, identity theft, and other security issues related to processing their tax returns. It is up to professional tax return preparers and online providers to ensure they are compliant with FTC Safeguards Rule and IRSA Publication 1345 so that they can continue providing secure services to their clients.

What are the Risks of ChatGPT for Accountants?

ChatGPT poses a number of potential risks to accounting firms and their cybersecurity. Chatbots are software applications that collect, store, and exchange data over the internet. This means that any unsecured data exchange through a chatbot is vulnerable to external interference and malicious attacks. Additionally, the greatest potential threat vector occurs when a malicious actor is able to gain access to the chatbot’s internal workings, they can uncover confidential information from clients or even manipulate data for personal gain. In order to protect against such threats, accounting firms should take measures such as encrypting data transmissions and implementing robust security protocols for all of their chatbot interactions. Furthermore, it is important for firms to thoroughly vet third-party ChatGPT providers before integrating any type of technology into their system.

Wrapping Up – ChatGPT for Accountants

ChatGPT is a powerful tool that has the potential to revolutionize the accounting industry by allowing firms to exponentially increase the number of clients they can take on, exchange information faster, more securely, and at lower costs compared to traditional communication methods. However, there are risks associated with the use of ChatGPT, such as the potential for data breaches, identity theft, and other security issues related to processing tax returns. Therefore, professional tax return preparers and online providers must adhere to FTC Safeguards Rule and IRSA Publication 1345 to protect taxpayer data and ensure secure services for their clients. Additionally, accounting firms should take measures such as encrypting data transmissions and implementing robust security protocols for all of their chatbot interactions, as well as thoroughly vet third-party ChatGPT providers before integrating any technology into their system. Hopefully this post helps you better understand if chatGPT is a viable option for accountants.

Tom Kirkham brings more than three decades of software design, network administration, and cybersecurity knowledge to organizations around the country. During his career, Tom has received multiple software design awards and founded other acclaimed technology businesses.

Tom Kirkham brings more than three decades of software design, network administration, and cybersecurity knowledge to organizations around the country. During his career, Tom has received multiple software design awards and founded other acclaimed technology businesses.